JETRO Invest Japan Report 2023

Chapter1. Inward FDI Trends in the World Section 3. Responses of Global Companies to Geopolitical Risks

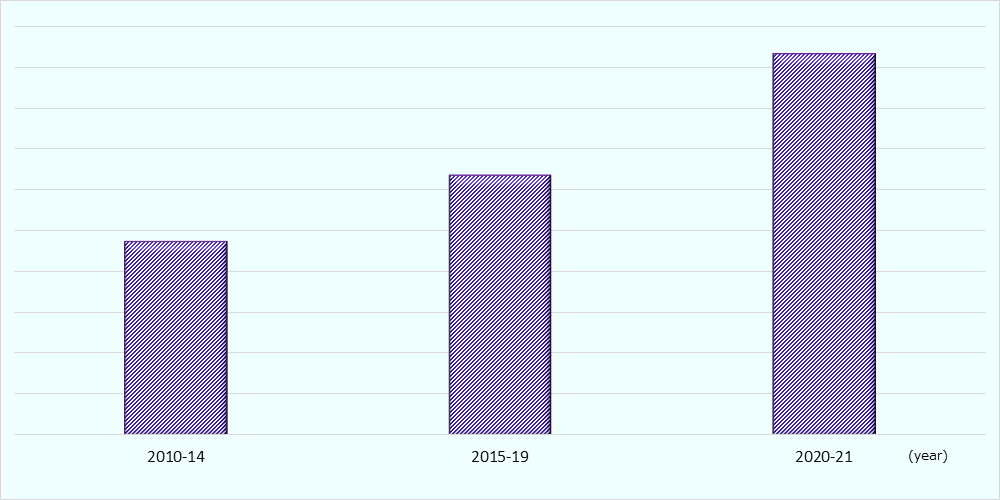

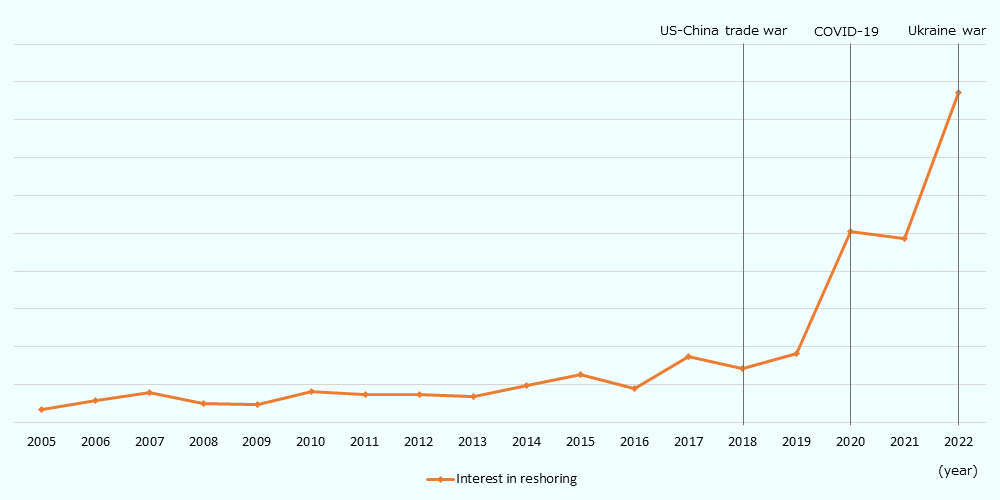

As international policy directions have been increasingly fragmented (Chart 1-3), geopolitical risks are rising and companies are getting more interested in reshoring. According to a survey by the International Monetary Fund (IMF), a rapid increase in interest in reshoring was particularly seen from 2019 to 2020 and from 2021 to 2022 (Chart 1-4). According to this survey, comparing companies that mention reshoring in their earnings calls with those that do not, statistically significant differences were found in profitability, percentage of intangible assets, sales, and number of employees, with particularly large differences in profitability and number of employees, showing that companies with higher productivity are more interested in reshoring.

-

Note:

Index based on the difference in voting behavior of the United States and China at the UN General Assembly. The higher the number, the greater the difference in voting behavior.

-

Source:

IMF Global Financial Stability Report (April 2023), Häge (2011)

-

Note:

The geopolitical risk index shows interest in reshoring and is measured by the frequency of references to "reshoring," friendshoring," and "nearshoring" in earnings calls.

-

Source:

IMF World Economic Outlook (April 2023), Hassan and others (2019), NL Analytics

JETRO Invest Japan Report 2023

-

Chapter1.

-

Chapter2.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

[Column 1]

-

[Column 2]

-

[Column 3]

-

-

Chapter3.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

Section7.

-

Section8.

-

Section9.

-

Section10.

-

お問い合わせ

フォームでのお問い合わせ

ジェトロはみなさまの日本進出・日本国内での事業拡大を全力でサポートします。以下のフォームからお気軽にお問い合わせください。

お問い合わせフォームお電話でのお問い合わせ

-

- 拠点設立・事業拡大のご相談:

- 03-3582-4684

-

- 自治体向けサポート:

- 03-3582-5234

-

- その他の対日投資に関するお問い合わせ:

- 03-3582-5571

受付時間

平日9時00分~12時00分/13時00分~17時00分

(土日、祝祭日・年末年始を除く)