JETRO Invest Japan Report 2023

Chapter2. Trends in Inward FDI in Japan [Column 2] With the recovery of inbound tourism, Japanese tourism assets is once again in the spotlight

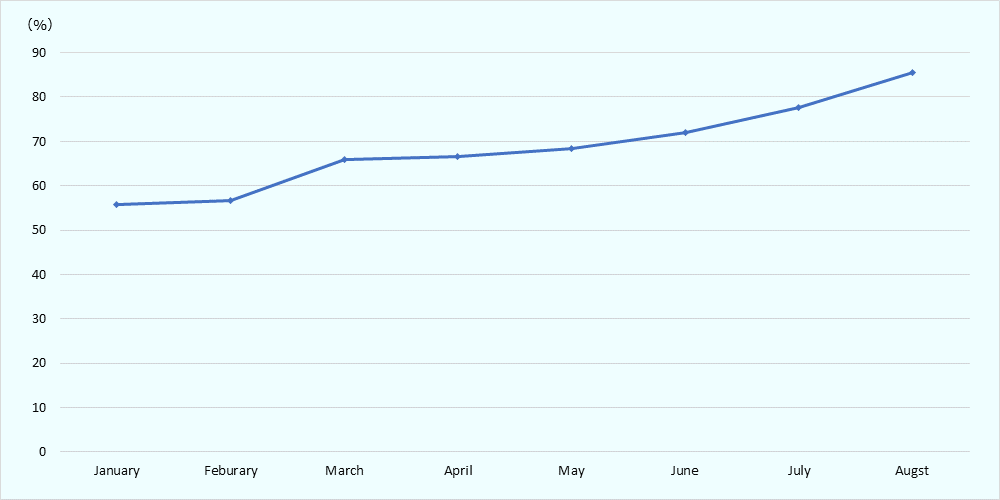

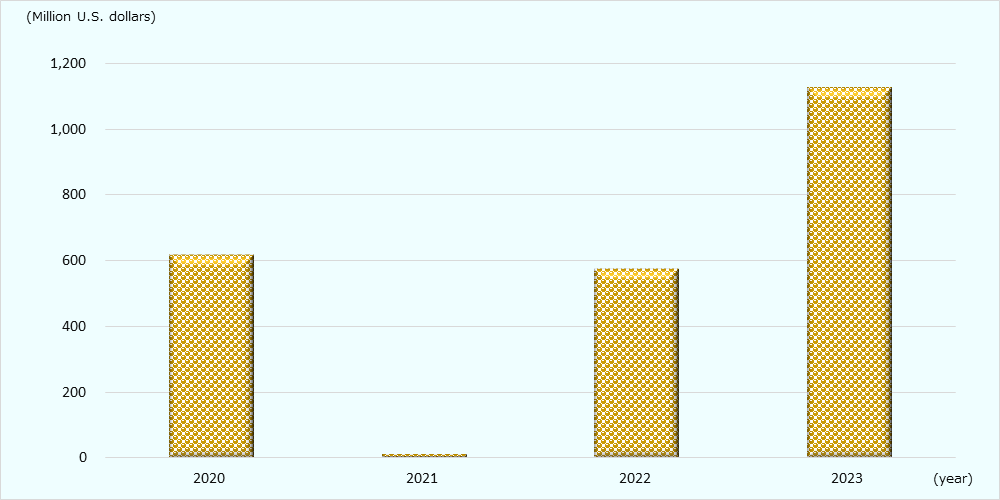

As shown in Section 6, greenfield investment in the tourism sector, which had been expanding steadily, saw a slowdown following the spread of COVID-19. On the other hand, foreign visitors to Japan began to recover in February 2022, accelerated significantly from the beginning of 2023, and recovered to around 85% of the level before the COVID-19 crisis as of August 2023 (Chart 2-21). In addition, looking at the trends in tourism-related M&A deals by foreign companies, we see a similar trend, bottoming out in 2021 and recovering from 2022 onward (Chart 2-22). Large-scale projects such as the case of Daiwa House Industry (Daiwa Resort) are emerging, and Japanese tourism assets are once again attracting attention (Chart 2-23).

(before COVID-19 pandemic)(compared to the same month)

Source: The Japan National Tourism Organization (JNTO)

Source: "Workspace" (Refinitiv)

| Acquisition Completion Date | Acquired Company: Company Name | Acquired Company: Business | Acquiring Company: Company Name | Acquiring Company: Ultimate Parent Company Location | Acquiring Company: Industry | Acquisition Amount |

|---|---|---|---|---|---|---|

| September 2022 | Huis Ten Bosch |

Leisure/ Entertainment |

PAG HTB Holdings | Hong Kong | Finance | 100 billion yen |

| July 2023 |

Daiwa House Industry (Daiwa Resort) |

Hotel | Investor Group (Japan Hotel REIT Advisors) | Singapore | Finance | 55.617 billion yen |

| July 2022 | KKDAY JAPAN | Travel portal | TGVest capital | Taiwan | Finance | 20 million dollars (95 million dollars, total from 2020) |

| March 2023 | Royal Hotel | Hotel | Blossoms Holding HK | Canada | Finance | Undisclosed |

| September 2023 | WD Holdings | Entertainment ticket arrangements | Vivid Seats | U.S. | Wholesale, Services | 8.7 billion yen |

| August 2023 | Bespoke Hotel Shinsaibashi | Hotel | City Developments | Singapore | Media, Entertainment | 8.5 billion yen |

JETRO Invest Japan Report 2023

-

Chapter1.

-

Chapter2.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

[Column 1]

-

[Column 2]

-

[Column 3]

-

-

Chapter3.

-

Section1.

-

Section2.

-

Section3.

-

Section4.

-

Section5.

-

Section6.

-

Section7.

-

Section8.

-

Section9.

-

Section10.

-

お問い合わせ

フォームでのお問い合わせ

ジェトロはみなさまの日本進出・日本国内での事業拡大を全力でサポートします。以下のフォームからお気軽にお問い合わせください。

お問い合わせフォームお電話でのお問い合わせ

-

- 拠点設立・事業拡大のご相談:

- 03-3582-4684

-

- 自治体向けサポート:

- 03-3582-5234

-

- その他の対日投資に関するお問い合わせ:

- 03-3582-5571

受付時間

平日9時00分~12時00分/13時00分~17時00分

(土日、祝祭日・年末年始を除く)